Case Interview Types: Master Common Ones Before Your Interview

- Last Updated January, 2024

![]()

![]()

![]()

Former McKinsey Engagement Manager

On Case Study Preparation, we described what a case interview question is and how you should approach answering one. You can think about that page as your Consulting Case Interview 101 course.

But if we could tell you how to ace your consulting case interview in just one page, Bain, BCG, McKinsey, and other top consulting firms would give out a lot more offers than they do every year.

On this page, we discuss the most common types of case study interview questions. We’ll take your understanding of how to answer these to the next level by outlining the key issues to consider when structuring your answer.

Let’s get started!

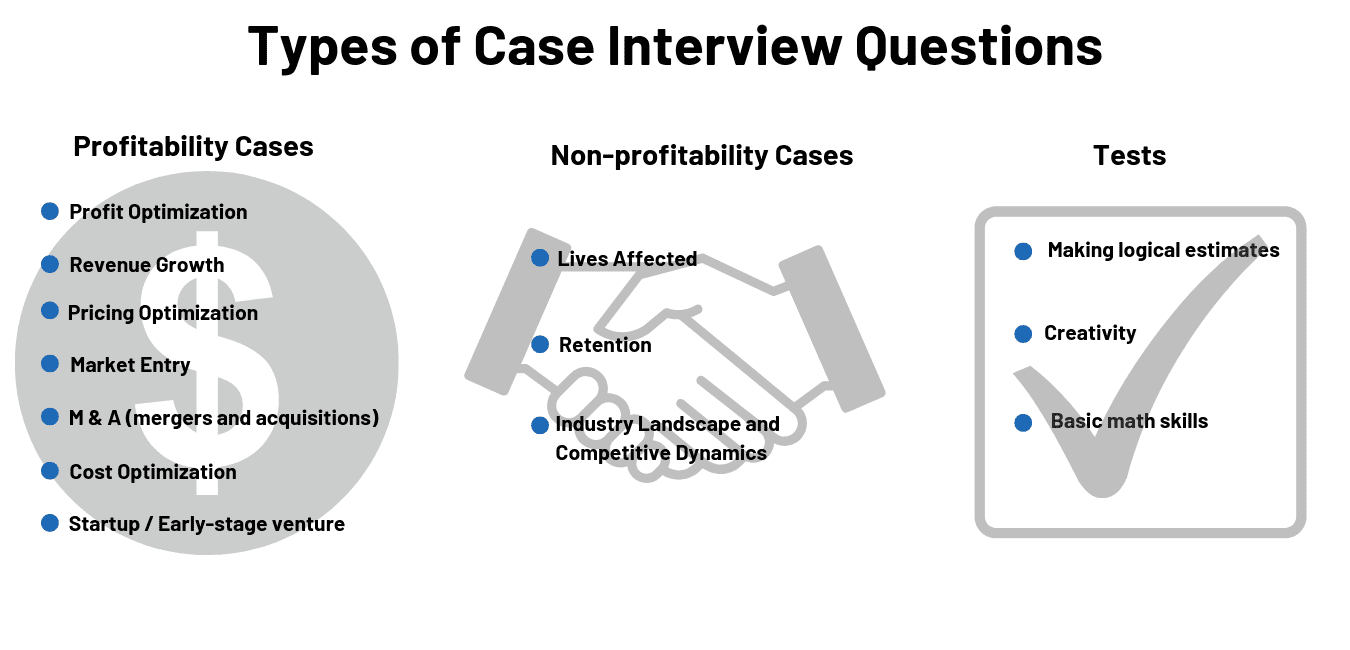

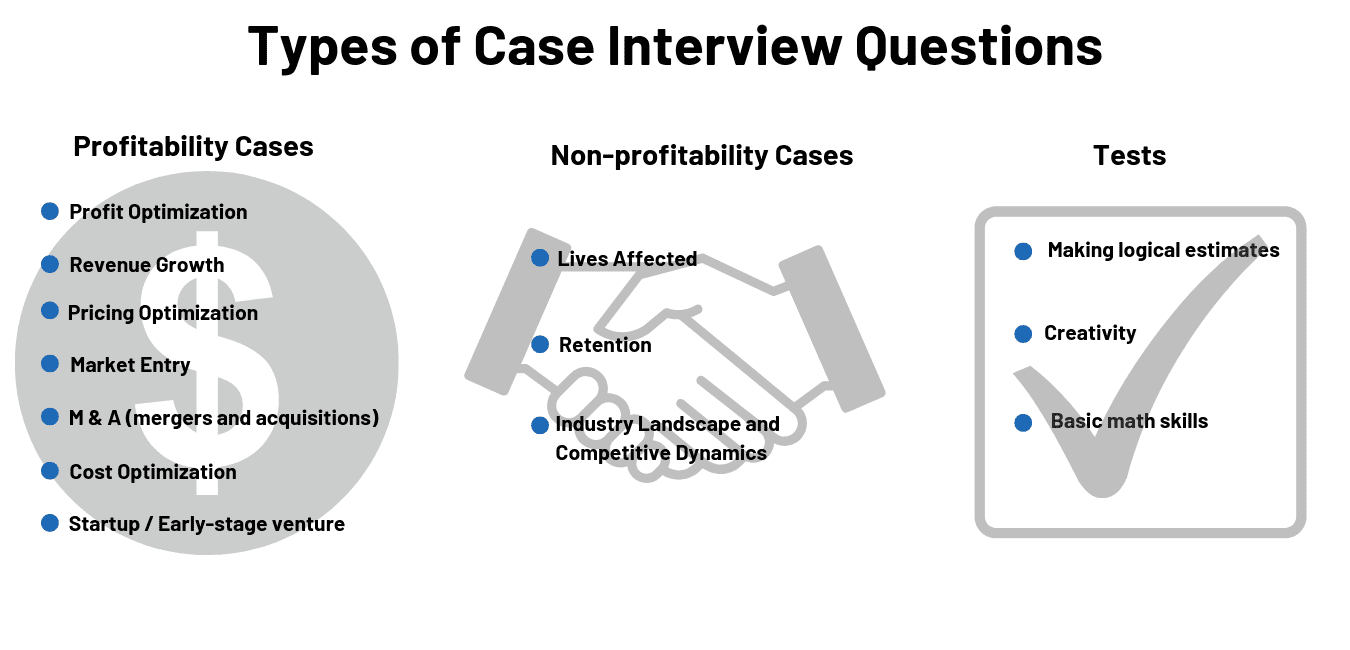

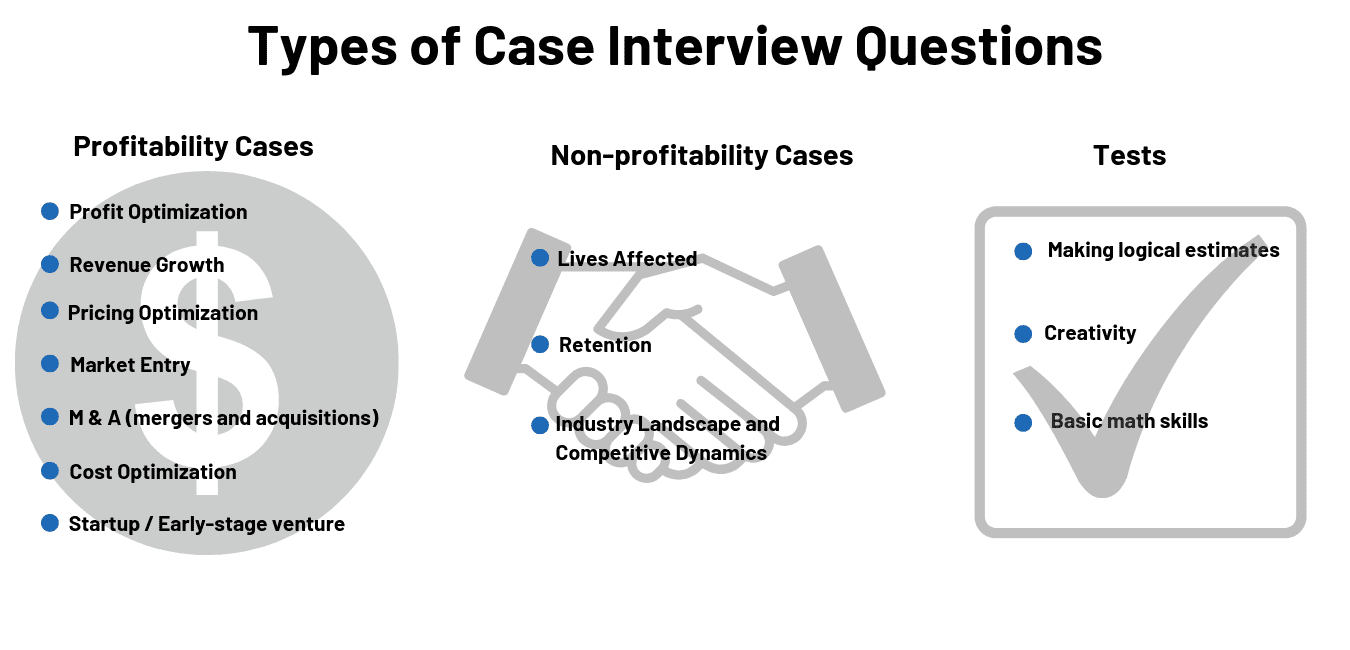

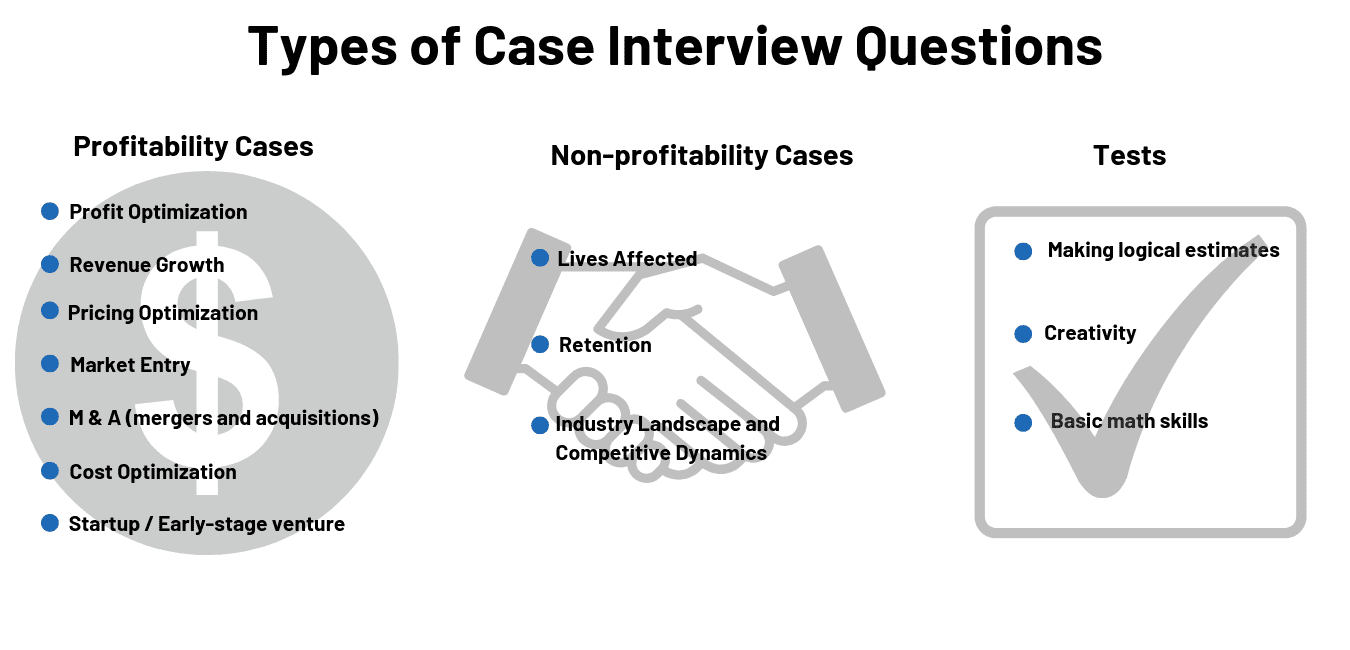

Here are the types of cases you might come across during your case interview:

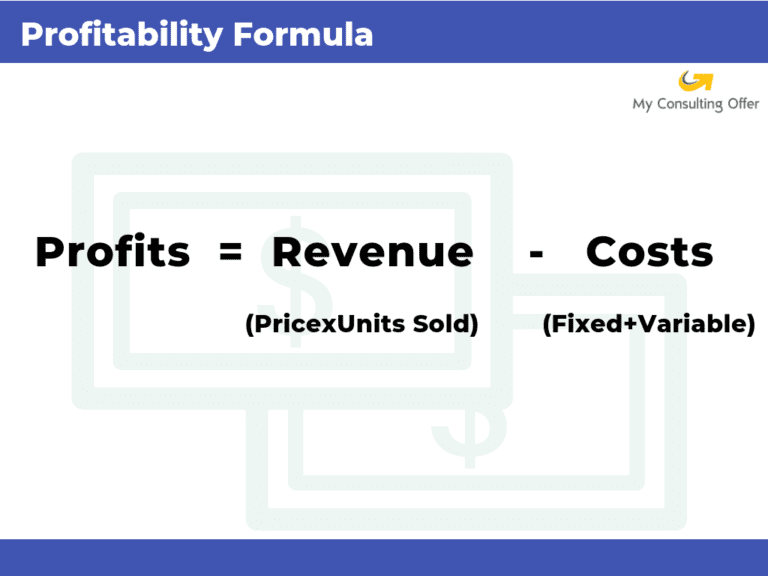

On this page, we discussed case interview frameworks that can help you structure your answers to case study interview questions, we introduced the profitability equation. It’s 1 of 2 basic business frameworks you can use to answer any type of case question.

This formula can help ensure you address all the key aspects of straightforward profitability cases like the following:

A sports apparel retailer has experienced declining sales in its stores over the past year and declining profits. How would you recommend they address their profitability problem?

Or

A cell phone manufacturer is experiencing declining profitability despite strong sales. What should they do to improve their bottom line?

For more detail on the components in this formula and an example of how to use it to solve a case interview question, see our Case Interview Frameworks page. Below, we’ll discuss types of profitability problems that go beyond the basics.

Perhaps a company is profitable…just not profitable enough.

Maybe its margins are lower than those of an industry rival.

Maybe they’ve dipped below its own prior-year performance.

Perhaps management sees an opportunity to launch a new product, leapfrogging the competition, but needs to generate more cash to invest in development.

Any of these can be reasons to improve the performance of an already profitable company.

Sample questions:

A nationwide fast-food chain failed to meet Wall Street expectations on its latest investor call and as a result, its stock price fell significantly. Management wants help identifying opportunities to improve the bottom line.

The CEO of a regional hospital chain is concerned that his company’s profitability is half that of the market leader. How can the company grow its net income?

In structuring your analysis of a profit optimization case, you should touch on all 4 components of the profitability equation to understand what the company is doing well and where things have taken a turn for the worse.

But the underlying problem in this type of case may be more subtle than in a basic profitability question.

Instead of a big jump in costs or the loss of a large customer wiping out a significant chunk of revenue, the company may be experiencing a couple of small problems that add up to bad news for the bottom line.

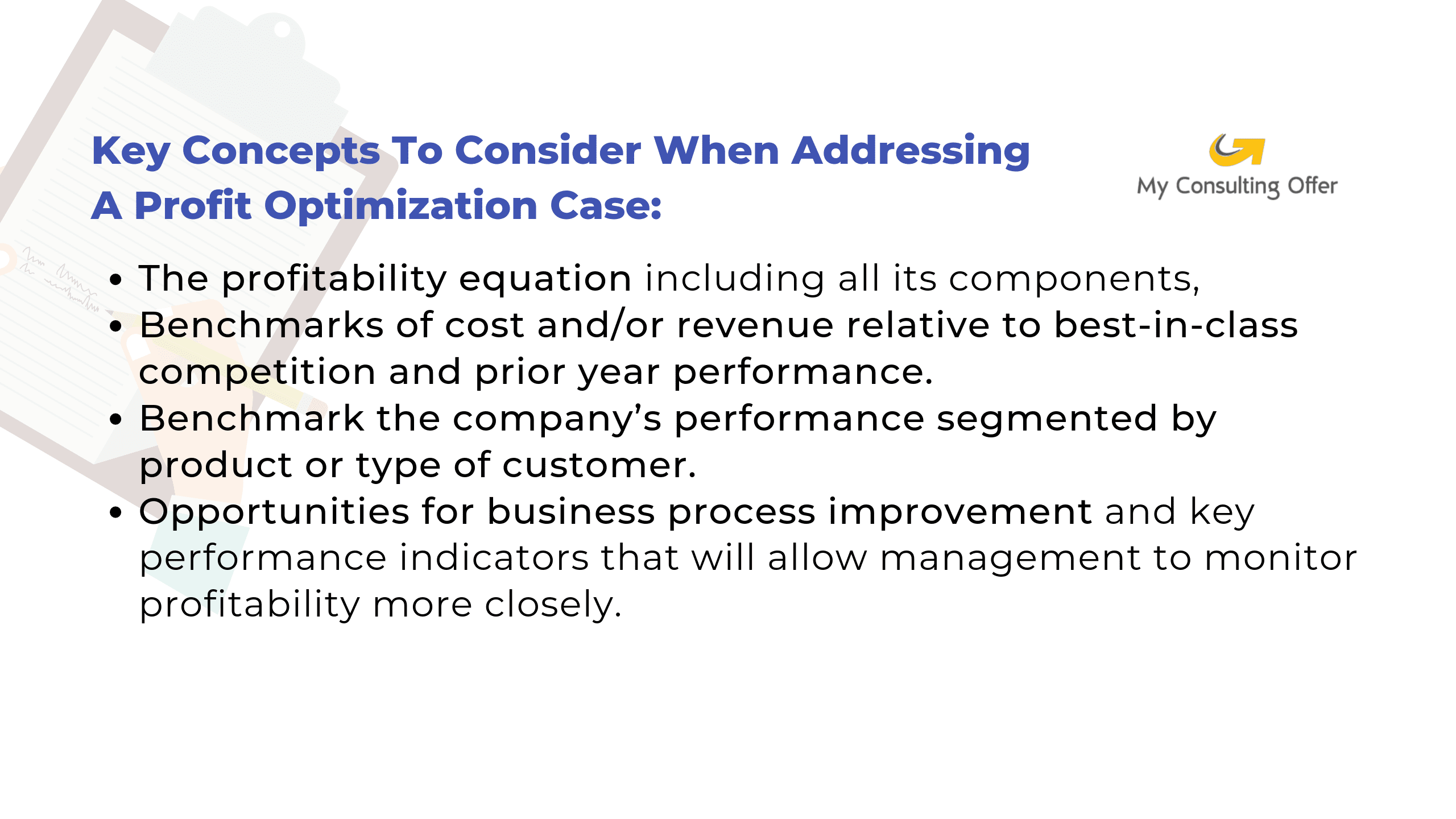

The answer to this type of case may require addressing multiple revenue or cost levers. To find which revenue or cost levers are out of line, benchmark relative to best-in-class competition and/or prior year performance.

The answer to this type of case may require addressing multiple revenue or cost levers. To find which revenue or cost levers are out of line, benchmark relative to best-in-class competition and/or prior year performance.

For example, if our client is a TV manufacturer and we find out that our cost of producing a TV has increased overtime while our prices have remained the same, we can see that rising costs is the reason for our profits declining.

To turn around the situation, we could look into what the competition is doing to reduce costs. For example, if a competitor is sourcing the same materials as us but from a cheaper supplier, we want to see if we can lower our cost by sourcing from the same supplier.

Another way consultants benchmark performance on revenue and cost levers is by comparing the performance in one business segment or type of end-customer to another.

Continuing with our TV manufacturing example, we might find that the client has seen costs rise on components in its high-end models but remain constant for its low-end models.

We can look into what is being done differently in the low-end product group: low-cost sourcing, process improvement, etc. to find opportunities to improve the cost position in the high-end segment.

The company may also need more disciplined business processes and a system for measuring key performance indicators.

Our TV manufacturer might institute a system for measuring cost per unit on a weekly or monthly basis in order to ensure they have an early warning system to monitor if costs are getting out of line.

To go with these KPIs, a regular process for reviewing the costs and taking necessary action could be instituted. Disciplined processes and performance indicators will help to fine-tune operations over time, taking them from good to best-in-class.

Key concepts to consider when addressing a profit optimization case:

The profitability equation including all its components,

Investors, whether they be stockholders of publicly traded companies, venture capitalists or private owners, consider revenue growth an important sign of business success. They reward companies that grow with higher valuations.

Investors, whether they be stockholders of publicly traded companies, venture capitalists or private owners, consider revenue growth an important sign of business success. They reward companies that grow with higher valuations.

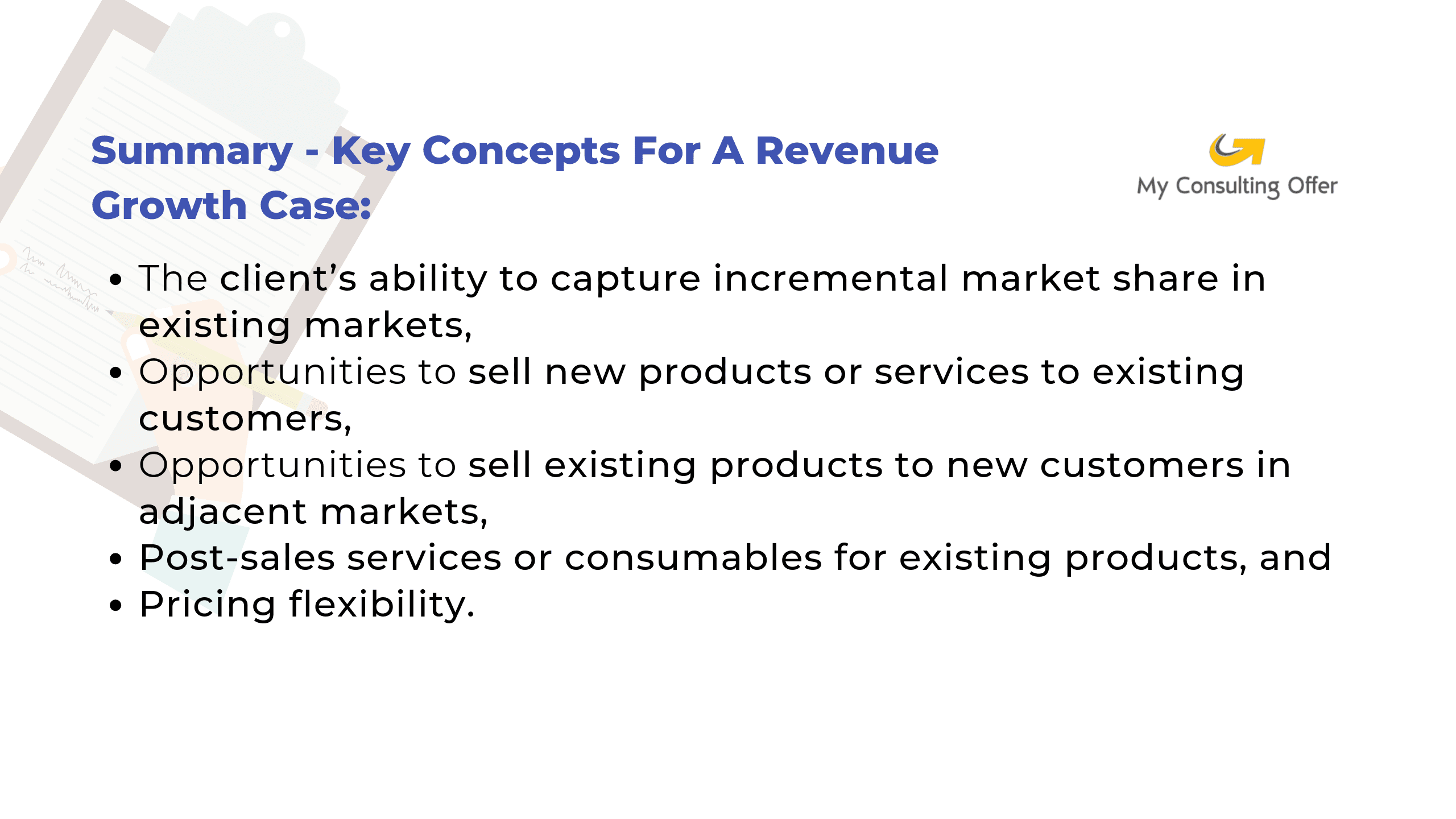

Revenue growth case questions focus on companies that, while already profitable, still want to grow.

They can do this by increasing market share, by selling their existing products to new markets, by selling new products to their existing customers, or by pursuing a combination of these opportunities.

They can also capture more revenue by increasing prices.

Sample questions:

A national chain of fitness centers wants to leverage its brand equity by selling additional products and services to its client base. What incremental products and services can profitably grow revenue?

The president of a printer and ink manufacturer thinks there is an opportunity to provide after-sale service to its customer base. What might be the impact on revenue from entering this market?

If a chain of fitness centers was our client, for example, we’d look at whether the primary competition was 1 or 2 large chains or a number of small, single-location gyms and tailor our strategy to increase market share accordingly.

If the competition was single-location gyms, we could promote flexibility for members to use our facilities in multiple locations to bring in new customers. We could also leverage the client’s greater size to outspend the small gyms on advertising.

Also, consider the new products and/or markets the company could branch into. What products do competitors sell that the company doesn’t? Does the company have capabilities that would help them succeed in other markets?

Our fitness center client could consider selling new products like fitness apparel or vitamins. They could expand into new markets, such as towns and cities adjacent to ones currently served.

In addition, consider services that can be sold to existing customers. Post-sales support for equipment, for example. Or consumables used with their products, like ink for a printer manufacturer. Our fitness center client could look into providing personal fitness coaching services to members.

Lastly, consider the company’s flexibility to raise prices. Where do their prices stand relative to competitive products or services? Do their products or services have higher quality or value-added capabilities that would command a higher price?

For more examples of revenue growth case interviews, see our Revenue Growth Case article.

Pricing optimization can be seen as focusing on one segment of a revenue growth case.

Pricing optimization can be seen as focusing on one segment of a revenue growth case.

A company must have a solid product or service offering to be able to take a price increase without seeing a significant loss of sales to competitors.

If their products or services are strong, then optimizing price can be an important lever to grow revenue.

Sample questions:

A manufacturer of kitchen knives sells a range of products, from low-end to professional, to customers at different price points. They’ve developed a new line of knives in collaboration with a celebrity chef and would like help setting the prices for these products.

The airline industry has experienced significant changes in its pricing model over the past few years, with some airlines charging separately for checked baggage, meals, and beverages. A global carrier has asked us to help optimize the pricing of the additional services it provides to customers who fly with them.

When prices rise, demand for a product goes down and when prices fall, demand rises. You’ll remember this from Economics 101, or perhaps just from common sense. Pricing optimization is all about how much.

If you can raise prices with demand going down just a little, you can improve a company’s revenues by raising price. If a change in price has a big impact on demand, then raising price could be a big mistake.

The term for this is Price Elasticity of Demand. If demand for a product or service changes a lot in response to a change in price, it’s said to have price elasticity. Products with many substitutes or ones that consumers can easily do without are the most sensitive to price changes.

For example, if McDonald’s raised the price of the Big Mac, more customers might go to Burger King, Taco Bell, or just eat lunch at home. McDonald’s hamburger sales would fall dramatically.

For some products, demand is relatively insensitive to changes in price. This can be the case for luxury goods, for products that have few substitutes, or for when there are large switching costs. When the cost of home heating oil rises, some customers consider switching to natural gas to heat their homes. But if doing so will require buying a new furnace to run on gas or paying for pipes from their house to the gas distribution network, they won’t make the change unless the change in price is dramatic and/or expected to persist for a number of years.

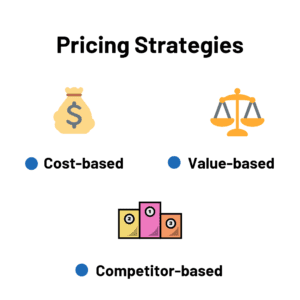

To answer a pricing optimization case, you must get a sense of how differentiated the product or service is from competitors, what substitutes exist, and what barriers there are that may keep customers from switching. Once you understand this, then consider these 3 methods for setting prices in your answer to this type of case:

To answer a pricing optimization case, you must get a sense of how differentiated the product or service is from competitors, what substitutes exist, and what barriers there are that may keep customers from switching. Once you understand this, then consider these 3 methods for setting prices in your answer to this type of case:

Competitive-based pricing — Setting prices based on the prices of other similar products in the market. This is the simplest method for setting prices. Companies who use competitive-based pricing are price takers.

Cost-based pricing —Setting prices as a function of the cost to provide a good or service plus a profit margin. Cost alone can’t be used to set pricing because if a company’s costs are out of line with its competitors, it may price itself out of the market.

Value-based pricing — Setting prices based on the value provided to customers. Luxury goods are priced well above the cost of their production because customers of these products value association with the prestigious image the product conveys. Products that provide significant value to customers in terms of saving time or providing features not found in other products can be priced higher because they are worth more to customers.

Value-based pricing the best pricing method but it can only be used for products and services that are sufficiently differentiated in the eyes of the customer that they will not change their buying behavior in response to higher prices.

Entering a new market is a big opportunity, but also a big risk.

Entering a new market is a big opportunity, but also a big risk.

Significant start-up costs will be incurred to develop and manufacture a new product, to launch the marketing campaign, or to build the sales force needed to find customers.

To ensure that spending money on start-up costs are worthwhile, due diligence needs to be done to estimate the size of the market being considered and the cost of successfully entering it.

Sample questions:

A teen fashion retailer has seen its sales boom in the North American market for the past 5 years. They’re considering expansion into international markets. They’d like help identifying which markets provide the best opportunities for their line of clothing.

A not-for-profit organization has been successful at hiring the long-term unemployed to manufacturer furniture made from pallets and other recycled items. They’ve not only designed and created beautiful pieces of indoor and outdoor furniture, but also helped to improve the lives of individuals in one city. They’d like to expand to other products and potentially to other cities and have asked for our help in assessing their options.

There are 4 parts to any market entry case: market size, market attractiveness, costs of entry and capabilities required. Let’s look at each.

Market sizing is sometimes used as a case interview question on its own. See below for more details. It’s also usually the first part of a market entry case. It addresses how large a market is in terms of annual revenue, number of units sold, or both. The underlying issue is whether there is enough opportunity in a market to make it worth the up-front cost.

To determine whether the amount of sales revenue or unit volume is “enough,” estimate the size of the market based on the information provided by your interviewer or by using factors you can reasonably estimate about the market. You can then consider profit margins and what portion of the market the company must capture to break even.

The market a company is thinking about entering may be huge, but it can still be unattractive. Key questions include: What is the profit margin for companies already in the market? What does the competition in the market look like? Large firms with huge marketing budgets or small companies?

Will new technology, equipment, sales staff, or something else be required to succeed in the new market? If so, what will it cost? The greater the investment required to enter a market, the more difficult it will be to recoup the initial investment.

Does the firm being discussed have what it takes to succeed in the new market? In some markets, the key to success is marketing expertise and distribution. In others, it’s low costs and disciplined business processes. Identify the key attributes of success in the market and whether the company possesses those attributes.

To learn how you can structure and break down a case such as these, visit the Case Interview Frameworks page can help you think through important factors in this type of consulting case interview question.

Above, we looked at how to analyze a market entry case.

If a market is attractive but the client does not have all the capabilities required to succeed in it, it may decide to buy the right capabilities through a merger or acquisition (M&A).

They could also consider M&A opportunities if they need to enter the market fast rather than build capabilities over time.

Sample questions:

The number 3 competitor in the cellular phone services market is at a disadvantage relative to its larger competitors. Providing cellular phone service has high fixed costs—for the equipment that transmits calls, the retail stores that sell phones and provide in-person customer support, and the marketing spend that is key to customer attraction and retention. The CEO is considering acquiring a smaller competitor in order to gain market share. He would like our help thinking through this decision.

The president of a national drug-store chain is considering acquiring a large, national health insurance provider. The merger would combine one company’s network of pharmacies and pharmacy management business with the health insurance operations of the other, vertically integrating the companies. He would like our help analyzing the potential benefits to customers and shareholders.

When you get this type of case, ask your interviewer why the company is considering the merger or acquisition. They may provide key information on the size and attractiveness of the market the target company is in. Assuming the target company is in a large, attractive market and has the critical capabilities required to succeed in that market, then you should consider whether it is better to build the new business internally or undertake a merger or acquisition.

Acquiring another company requires a willingness to pay a premium to current shareholders for their stock.

Acquiring another company requires a willingness to pay a premium to current shareholders for their stock.

If two companies are considering a merger, they still have to persuade their shareholders that the 2 companies would be more valuable working together than on their own. The value the companies can create by working together is called synergy.

Synergies from a merger or acquisition can be on the cost side, the revenue side, or both. Cost synergies include leveraging fixed costs across more business or cutting costs duplicated in both firms’ operations. Revenue side synergies include selling a broader range of products through the existing sales force or distribution channel.

The synergies created by the merger or acquisition must be greater than the premium that must be paid to secure the deal in order for the transaction to make sense.

Mergers and acquisitions are large and complicated transactions. They require integrating the talent, systems, policies, and processes of the 2 organizations. Synergies that look good on PowerPoint slides do not always accrue in real life. In addition, key employees may quit during the disruption and uncertainty the M&A activity causes. Even if substantial synergies are identified, a company should consider whether it can successfully undertake the integration.

Lastly, mergers of large companies in regulated markets (financial services, telecommunications) and concentrated markets (ones with only a few large competitors) can require government approval. The possibility of the government blocking the merger or acquisition should be considered in this type of case.

Cost optimization cases focus on the second half of the profitability equation — fixed and variable costs.

Cost optimization cases focus on the second half of the profitability equation — fixed and variable costs.

Sample questions:

A top-3 home improvement retailer has seen price increases from several of its vendors, squeezing its bottom line. The company wants to know how it can cut costs to restore its margins to their previous levels.

The head of an automobile manufacturer has seen its production costs rise over the last several years. She wants your help in turning around this trend.

The most important thing to understand when addressing this type of case is what is going on with fixed costs and variable costs. The costs can be broken down and compared to competitors’ costs or costs in prior years to identify opportunities for improvement.

As a reminder, here are the definitions of fixed and variable costs:

Costs that you incur just because you are in business regardless of how many units you sell. Examples: factory rent, equipment depreciation, compensation for salaried employees, and property taxes. A way to think about fixed costs is that a cost that does not change over the short-term, even if a business experiences increases or decreases in its sales volume.

Costs that only incur when you begin to produce units (if you sell nothing you have no variable costs). Examples: sales commissions, credit card transaction costs, and sales taxes. A way to think about variable costs is that a cost that does change over the short-term. More sales volume will mean more variable costs.

Startup and early-stage venture cases have some similarities to market entry cases.

Ensuring that the market the company is going after is big enough and has high enough margins to be attractive is important, as is understanding their competition.

Startups are small, nimble companies with only a handful of key employees and limited access to cash. These factors need to be taken into account.

Sample questions:

A student from Iceland studying in the U.S. has determined there’s a big opportunity to bring Icelandic-style yogurt to this market. How would you recommend he proceed?

A software company has developed video technology that can be used to quickly and easily create short videos that can be sent to a colleague in place of typing a long email. This disruptive technology will take advantage of the cameras built into cell phones and laptops as well as consumers’ preference for watching a video rather than reading text. The company has a small number of beta customers and is looking for advice on how to ramp up their product to attract a wider audience.

When answering this type of case, focus on the key things that help these small, fast-growth ventures move with agility as they search for the product and business model that will attract customers and investors.

They need the right people—ones with product savvy, marketing savvy and investor savvy to make it.

They need a minimum viable product. This is an initial version of their product offering that will attract paying customers, allowing them earn money and to collect feedback that can be used to improve the product. It will also serve as a proof-of-concept to investors.

Start-up and early stage venture also need an initial business plan addressing how they will bring their product to market.

Not all case study interview questions have to do with revenues and costs.

Not all case study interview questions have to do with revenues and costs.

Some might focus on charitable organization. Others might focus on businesses issues that don’t relate directly to profits, such as employee retention or understanding the competitive dynamics in an industry.

An overview of how to approach non-profitability cases is found on this page.

This section focuses on key concepts to address in a few common types of non-profitability cases.

Government agencies and charitable organizations don’t aim to maximize profits. Nonetheless, they do important work that affects many lives.

They might hire a consulting company to help them improve their effectiveness, or a consulting firm might take on an important project for a charitable organization on a pro-bono basis.

Sample questions:

The state agency that administers the free summer lunch program for children of families under a certain income threshold wants to increase the reach of its program. How would you advise they approach this?

Malaria is a devastating disease, affecting hundreds of millions of individuals each year. It’s transferred to humans by mosquitoes, with most of the cases occurring in South Asia and Sub-Saharan Africa. Though drugs to treat the disease exist, many in the affected regions don’t have access to or can’t afford these drugs. The disease is a strain on the economies of several nations, perpetuating the cycle of poverty. What can be done to alleviate this disease and its adverse economic effects?

A detailed example of how to approach a lives affected case is provided here. As discussed in that case, the key to answering this type of question is to find the key performance indicator (KPI) the organization is trying to improve. In the case of the first sample question above, this is the number of free lunches served to needy children.

Once you’ve established the KPI, the case can be answered in the same way you’d answer any case question on business improvement. You can benchmark the organization’s performance by looking at trends in the KPI over time or comparing the growth of the organization’s KPI to that of other organizations serving the same target population to assess whether the agency is doing a good job meeting their mandate or falling behind. If they are falling behind, drill down into the factors that might be causing them to do so.

Cases focused on employee retention are not directly about profits, though the loss of key skills when employees depart and the cost of training new hires require hurts the profitability of organizations with high turnover.

Sample questions:

A fast-food chain is experiencing an increase in the already-high rate of employee turnover typical in its industry. It’s also experiencing trouble attracting qualified new employees. What would you suggest?

The school system in a middle-class suburban town is experiencing higher-than-normal rates of teacher attrition. With a tight budget, they are unable to simply raise salaries to hold onto experienced teachers. What options does the school system have for increasing teacher retention?

Conducting retention interviews—interviews with departing employees to find out why they’re leaving the organization—is a standard practice in most organizations. Because of this, there should be data available on what employees like about their jobs, don’t like about their jobs, why they looked for new opportunities and what new job they’re taking. Ask your interviewer for this information, as well as survey data on the job satisfaction of all employees. It can be used to develop a multi-pronged approach to improving employee retention.

Cases focused on the landscape of an industry and its competitive dynamics are about the big-picture strategic issues that must be taken into account to compete effectively in that industry.

Sample questions:

The traditional newspaper industry is facing heavy pressure from free online news organizations that don’t face the cost of printing a traditional newspaper and are able to leverage Internet ads as a source of revenue. The publisher of an award-winning regional paper would like your help in assessing and responding to this new threat.

The food and beverage industry faces disruption to their traditional brands as organic and small-batch products gain favor with consumers. How should companies in this industry respond to this new of competitive threat?

When analyzing this kind of case, first look for what is changing in the industry—consumer preferences, brand loyalty, barriers to entering the market, regulation, the industry’s cost structure, etc. Ensure you know what the source of change is before you begin to look for a strategy to help the client succeed in the new marketplace.

For tips on structuring a case like these, visit the Business Frameworks page. SWOT analysis and other frameworks include some factors to consider in this type of consulting case interview question.

Market sizing cases are focused on establishing the size of a market in terms of annual revenue or the number of units sold rather than determining how to compete successfully in the market.

Consulting firms often ask market sizing questions early in the consulting interview process or in interviews of undergraduate students who may not have a deep business background.

They can also be one component of complicated, multi-step cases in later-round interviews. Market sizing questions focus on making logical estimates, showing creativity, and doing basic math.

Sample questions:

What is the size of the market for organic toothpaste in the United States?

How many golf balls would fit inside the Empire State building?

With case interview questions of this type, you’re not expected to know the answer, but instead to show a logical way of deducing it. Committing a few key facts to memory would serve you well. For example, knowing the population of the United States (or the country you live in) would give you a good place to start as you think through the size of the market for various retail goods. Gross domestic product can help with sizing industrial markets.

The Population of the United States 2019 – 329 million according to the US Census Bureau.

World population in 2015 – 7.4 billion according to the United Nations DESA / Populations Division.

2018 Gross Domestic Product of the United States – $20.5 trillion according to the Bureau of Economic Analysis of the U.S. Department of Commerce.

Statistics like these give you a good foundation to start your market size analysis. For instance, you could begin estimating the size of the U.S. market for organic toothpaste with the US population. From there, make logical assumptions:

These assumptions will allow you to calculate the size of the overall toothpaste market in terms of annual revenue. To get to the annual revenue of organic toothpaste you’ll also need to estimate:

You can (and should) bring paper and a pen into consulting interviews. Use these to keep track of your assumptions as you work through them and to do the basic math required to come to a conclusion.

Our Market Sizing Questions article has a list of the 7 steps to answering this type of question.

Management consulting interviewers screen candidates to ensure that they can do basic math.

Don’t worry if you didn’t ace multivariate calculus, the math is usually basic arithmetic—addition, subtraction, multiplication, division and fractions/percentages. You may also be asked to extract data from charts and convert from one unit of measure to another.

As mentioned in the discussion of market-sizing case questions above, you can and should bring a paper and pen into the interview. It’s fine to write out your calculations.

As an example of consulting math, we’ll use the estimate of the U.S. market for organic toothpaste we worked through in the market sizing case, but here, we’ll go step-by-step through the calculations.

As an example of consulting math, we’ll use the estimate of the U.S. market for organic toothpaste we worked through in the market sizing case, but here, we’ll go step-by-step through the calculations.

In each step, we’ll provide a sense of how we are making the estimate so that the interviewer knows we’re not just grabbing a number out of the air. We want our answer to be as grounded in fact as possible.

The population of the United States: 329 million. We’ll round to 330 million for simplicity.

The number of times the average American brushes their teeth – 2 times per day. Some people brush at lunchtime too, but that’s probably offset by people who only brush once a day.

330 million people brushing 2x’s per day gives us 660 million toothpaste applications/day.

To get to an annual number of toothpaste applications, we need to multiply by 365. That’s 241 billion toothpaste applications. We’ll round to 240 billion for simplicity.

A tube of toothpaste usually lasts me about 2 months. That means we need to divide by 120 toothpaste applications per tube to come up with the number of tubes sold annually (2 months x 30 days/month x 2 applications/day). 240 billion toothpaste applications / 120 applications per tube = 2 billion tubes of toothpaste sold in the U.S. every year.

The cost of toothpaste ranges from $1 for inexpensive brands to $4 for expensive brands, but the average cost is probably about $2. This means the total revenue for toothpaste sold in the U.S. is 2 billion tubes x $2 or $4 billion.

The percent of the toothpaste market that’s organic is a little tricky to estimate. In the grocery store I shop in, there’s 1 aisle of organic goods in a store that has 20 aisles – that means organic products make up 5% of shelf space (and presumably also of sales).

I think that people would be less likely to buy organic toothpaste than organic food, because you eat organic food, but you spit organic toothpaste out into the sink. Organic products always cost more and organic toothpaste doesn’t seem quite as important to your health.

Conclusion: Based on that, I’ll say that 1% of the market for toothpaste is organic, so if $4 billion in toothpaste is sold in the U.S. every year, $40 million of it is organic toothpaste.

Is our answer right?

Probably not exactly. There are different sizes of toothpaste tubes, a complication that we did not consider in this analysis. There might be some people who don’t brush their teeth every day. That would mean that we overestimated consumption.

But our estimate of the market size for organic toothpaste is reasonable and grounded in logical assumptions. We could sniff-test our answer by comparing it to a market size we know, or to GDP, one of the facts we suggested having in your back pocket for market sizing case questions.

U.S. GDP was about $20 trillion in 2018. Our estimations suggest that the overall toothpaste market is $4 billion. That means toothpaste is 1/5,000 of the U.S. economy, and the market for organic toothpaste is 1% of that.

That sounds plausible. If your answer showed that the market for organic toothpaste was larger than U.S. GDP, it would be a clear indication that you made a mistake somewhere along the way.

For the 4 types of math problems you’ll be asked to compute as part of case studies, read Case Interview Math.

Above, we’ve provided you with 11 different types of case interview questions you might be asked during your consulting interviews. We’ve also told you that you need to get great at doing case math.

Overwhelming? It can be.

But it doesn’t have to be.

The best way to prepare for your consulting case interviews is NOT to spend hundreds of hours reading every case study question and answer you can get your hands on. Instead, see our page on Case Interview Practice to find out how to make the most of your interview prep time. In addition, check out this video where Davis Nguyen, Founder of My Consulting Offer, talks about how mastering the case interview is made easier when you focus on the most common types of cases.

Here in an online workshop he conducted for Columbia University, NYU, and Cornell students, you can see why this approach is so effective:

After studying the information on this page, you have an in-depth understanding of the types of cases you could be asked to analyze in consulting interviews. From Davis’s video, you know why this is so important to focus on the main types of cases. You’re well prepared to find a case study practice partner and begin practicing.

As you prepare for case interviews, you should use this page in conjunction with Case Interview Examples, where you’ll find links to sample case study questions and their answers. Remember that while it is important to discuss all the appropriate aspects of a business case, it’s important to structure your analysis and your answer. Refer back to our page on Case Interview Frameworks to ensure that you’re not just practicing more cases, but doing them better.

If you still have questions, leave them in the comments below. We’ll ask our My Consulting Offer coaches and get back to you with answers.

Thanks for turning to My Consulting Offer for advice on case study interview prep. My Consulting Offer has helped almost 89.6% of the people we’ve worked with get a job in management consulting. For example, here is how Thomas was able to get a BCG offer with just a short time to prepare..